A new analysis of energy finance, available online at RethinkX, shows that Conventional Power Plants (CPP) have been losing out rapidly to renewable energy, and are now seriously over-priced. Convential energy overvaluations have created a large and rapidly expanding global financial bubble. The total lifetime energy production minus their total costs for conventional coal, gas, nuclear and hydro power assets has been grossly over-estimated.

Estimators assumed their conventional assets would continue to successfully sell the same quantities of electricity for the next 20-30 years. This assumption made for easy spreadsheet calculation. Just multiple by number of years of standard operation. This turn out to have been a disasterous optimistic assumption, and has fooled investors by producing lower LCOE figures. (Levelised Cost Of Energy).

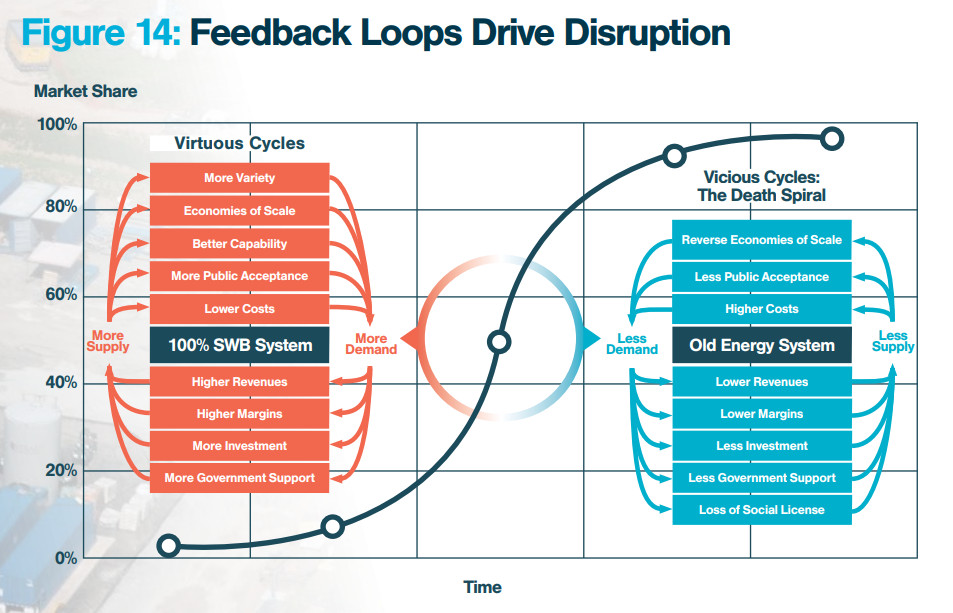

Renewable energy plus storage has minimal running costs, and is purchased in competition. This steals the lunch money from CPP every day. Assume now, instead, that Solar, Wind and Battery (SWB) installations continue to grow exponentially world wide. Their rapid growth beyond current rates is essential for any kind of rational global climate policy. Just about every fossil fuel investment friendly institution has committed the same error. They have bet their control of the energy market on it.

Carbon-Tracker has long been documenting, that most of the world's fossil fuel reserves are now stranded assets. They cannot be burned if civilisation is to survive future global warming. Nations now have to also face that their any recent investments in fossil energy burning infrastructure are also stranding assets. Very soon, their investment monies will fail to pay back debts. The fossil fool corporations instead are attempting to impose their control of governments, to artificially raise energy prices and impoverish national economies and general public.

Such measures are being used to cover for bad investment decisions, such as electricity supply grid overbuilds for CPP, and underbuilds for SWB, such that in Australia, previously approved SWB projects have been refused timely connection. The CPP and grid owners in Australia want to charge private solar panel owners for recieving free energy in the form of solar panel outputs on suburban roofs. Was this possibility mentioned in the terms for government subsidy of solar panel installations? Being caught out and missing the change is the result of over of a decade of hostile and uncertain cclimate and energy policy, from retrograde inferior quailty Australian politicians.

The mistake is becoming very apparent. As SWB undercut energy supply in every market, the base load dinosaurs have been declining in capacity factor. In the USA the average capacity factor for coal fell from 67% in 2010 to 40% in 2020. First there was subsidized cheap gas from fracking, and most recently the growth of SWB. In the UK the collapse was from 58% in 2013 to just 8% by 2019. Just imagine every big CPP investment going down the toilet over the next 10-20 years. Failure to embrace change is causing a growing disaster of economic losses.

False assumuptions have made conventional energy assets appear to be much more attractive than they actually are. Perhaps 3-5 times on average over their reduced economic lifetimes. They were able to attract far investment, in the last ten years, world wide over $2.2 trillion dollars for conventional electricity. Any thinking that includes carbon capture and storage is doubly overvalued, and financially unviable. As with the stranded unburnable carbon assets, at least 80% of current investment placed in these assets must be considered to have been thrown down the toilet.

The current mad gas craze of the Australian government is to stand back and allow foreign corporates to carry out gas fracking operations everywhere in multiple states.These players face potential huge finanical losses, plus absolutely certain wide spread ecosystem devastations. No compensation is on offer for ongoing high greenhouse gas emissions, and permanent loss of alternative sustainable economic returns over the entire continent of Australia.

Three degrees of average global warming, is now most likely to be exceeded by the end of this century, and this will halt most of the current economic and biological life support activity over most of the Australian continent. Temperatures advance by one degree every 40 years. We are well enough past one degree already. Nobody can be sure that new global climate tipping points won't be activated to accelarate the pace of global warming over the next 80 years. Various stock and bond markets should not resist gravity pull of devaluation for stranded assets for much longer. With severe climate risks, a death spiral for fossil fuel assets and their finance is overdue.

Add Comment

This policy contains information about your privacy. By posting, you are declaring that you understand this policy:

This policy is subject to change at any time and without notice.

These terms and conditions contain rules about posting comments. By submitting a comment, you are declaring that you agree with these rules:

Failure to comply with these rules may result in being banned from submitting further comments.

These terms and conditions are subject to change at any time and without notice.

Comments